milwaukee wi sales tax 2020

31 rows Wisconsin WI Sales Tax Rates by City. Over the past 24.

View These Jobs And More By Clicking The Link Careers Finance Valuation Accounting Business List Of Jobs Job Opening Career

The total requested tax levy for 2020 is 336 million which would be an increase over the 2019 Adopted Budget of 42 million or 14 percent.

. 15719 2017 3510 3rd Avenue South Milwaukee WI 53172. South Milwaukee Sales. Free tax preparation services offered in Milwaukee.

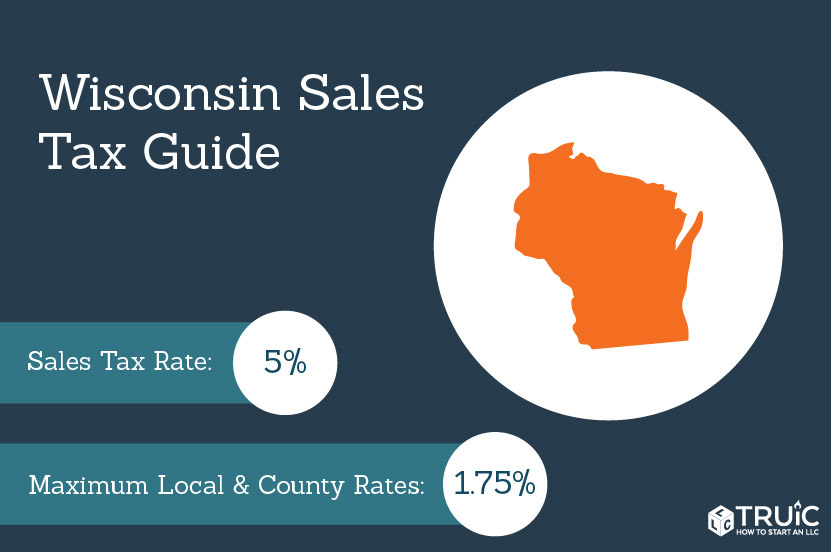

The Wisconsin sales tax rate is currently 5. The Milwaukee sales tax rate is. Free tax preparation services offered in Milwaukee County.

Beginning with tax year 2018 we will no longer report total amounts billed for qualified tuition and fees. Fast and easy 2022 sales tax tool for businesses and people from South Milwaukee Wisconsin United States. The County sales tax rate is 05.

The 55 sales tax rate in South Milwaukee consists of 5 Wisconsin state sales tax and 05 Milwaukee County sales tax. The Wisconsin state sales tax rate is 5 and the average WI sales tax after local surtaxes is 543. Yesterday we passed a bill that finally sets an end date for the Miller Park Stadium sales tax.

This is the total of state county and city sales tax rates. Rate variation The 53211s tax rate may change depending of the type of purchase. The 55 sales tax rate in Milwaukee consists of 5 Wisconsin state sales tax and 05 Milwaukee County sales tax.

Wisconsin has 816 special sales tax jurisdictions with local sales taxes in. Prior to tax year 2018 the University of Wisconsin-Milwaukee reported the total amounts of qualified tuition and fees billed during the relevant tax year in Box 2 of Form 1098-T. You can print a 55 sales tax table here.

La Tonya Johnson D-Milwaukee plan to introduce a local option sales tax to the Wisconsin Legislature this fall. As of May 15 Milwaukee County has so far collected 33 million in sales tax revenue for 2020 a slight decrease compared with 333. The Milwaukee County Sheriff has real estate auctions every Monday morning on properties that are lender foreclosures due to non-payment of the mortgage.

There is no applicable city tax or special tax. 01 lower than the maximum sales tax in WI. The total requested tax levy for 2020 for operating purposes is 298 million which would be an increase over the 2019 Adopted Budget tax levy for operating.

At least for now consumer spending in Wisconsin is bucking projections that the COVID-19 crisis could cause counties to experience significant losses in. If you are interested in a property included in one of the Sheriffs auctions. The minimum combined 2021 sales tax rate for Milwaukee Wisconsin is 55.

For tax rates in other cities see Wisconsin sales taxes by city and county. The 01 tax will end for good on March 31 2020. Top Property Taxes South Milwaukee.

Counties and cities can charge an additional local sales tax of up to 06 for a maximum possible combined sales tax of 56. There is no applicable city tax or special tax. These include the 05 sales tax that will soon be imposed on 68 of 72 Wisconsin counties the soon expiring 01 stadium sales tax in Milwaukee Ozaukee Racine Washington and Waukesha counties.

The 53211 Milwaukee Wisconsin general sales tax rate is 55. 3705 3rd Avenue South Milwaukee WI 53172. Higher sales tax than 99 of Wisconsin localities.

If approved a referendum would be brought to Milwaukee County voters in Spring 2020. The combined rate used in this calculator 55 is the result of the Wisconsin state rate 5 the 53211s county rate 05. Office Closed on the following City Holidays.

Sales Advertising. 01 lower than the maximum sales tax in WI. Basic room tax 25 - Increases to 3 effective January 1 2021.

The following sales and use tax rates apply to taxable sales and taxable purchases made in the five Wisconsin counties in the baseball stadium district Milwaukee 55 includes 05 county tax Ozaukee 55 includes 05 county tax Washington 55 includes 05 county tax Racine 50. Free online 2022 US sales tax calculator for South Milwaukee Wisconsin. Monday through Friday 815 AM.

The state sales tax rate in. State sales and use tax 5 County sales and use tax 05 Baseball stadium district sales and use tax 01 - This tax ended March 31 2020. How 2022 Sales taxes are calculated for zip code 53211.

Additional information is available by calling 414-278-4907 between 8 am. Groceries and prescription drugs are exempt from the Wisconsin sales tax. You can print a 55 sales tax table here.

12542 2017 220 Edgewood Avenue South. December 24 27 and 31 2021 and January 3 and 17 2022. Evan Goyke D-Milwaukee and state Sen.

The Milwaukee County Wisconsin sales tax is 560 consisting of 500 Wisconsin state sales tax and 060 Milwaukee County local sales taxesThe local sales tax consists of a 050 county sales tax and a 010 special district sales tax used to fund transportation districts local attractions etc.

1108 W Oklahoma St Appleton Wi 54914 2 Beds 1 Bath Fenced In Yard Appleton Cozy Decor

2022 Wisconsin Federal Labor Law Posters

Pin On Real Estate Working Girl

Kenosha Property Management Investment Property Brokers In Milwaukee Wi Choose The Right Property Manag Fha Mortgage Mortgage Rates Real Estate Investing

Wisconsin Sales Tax Small Business Guide Truic

2022 Wisconsin Federal Labor Law Posters

223 N Green Bay Rd Appleton Wi 54911 4 Beds 2 Baths Cozy Decor Appleton House Prices